People are flocking to small cap funds like the zombies run

towards humans in movies. We have seen this earlier and trust us, this is not gonna

have a happy ending. Why so, because we are at the climax and you all know what

happens to the zombies at the end of the movie, they all are trapped in one

place and get finished off. So, why do I connect zombies with small cap fund investors

now?

Read on –

Zombies don’t think – as you would have seen in the movies,

all the zombies just run when they sense a living being. Similarly, the frenzy

today is, all the investors are flocking towards small cap funds without giving a second thought, just because

it has given good returns in the last few years . Zombies fall for the trap – Z’s don’t know what is about to

happen next. They flock and fall for the trap laid out as expected. Humans are also

the same, they run where the returns are higher and end up making worse

mistakes.

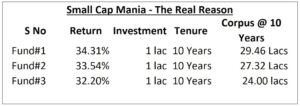

Enough of zombies, lets get to facts now. The one single

reason for people to throw their money at small cap fund is simply because it

has delivered excellent returns in the last few years. Some funds have delivered

returns in excess of 30% yearly. Below is the returns profile of Top Small Cap Funds in last 3 years –

To give it more context, lets extrapolate these returns over longer periods, the pysche thats making us Zombies –

As One Honest Human to another, I would not blame you if you become a Zombie. I mean where on the universe is your mearge 1 lac turn into 30 lacs? Its natural to think – “Lets invest 3 lacs and stay put for 10 Years, We will make a crore rupees and retire for good” In a zest to earn crores of Rupees, people are taking

reckless decision with their hard-earned money with zero understanding of the risk associated . Either they are ignorant, or

they are being advised poorly.

I can read your mind… so, should we stop investing in small

cap fund is what your question is?! No, all we say is that people should not chase

returns and expect similar returns in the future as well. Also, one should

understand how risky and volatile investing in small cap fund is. Below is the

draw downs the small cap funds have faced in last 20 Years –

There are atlest 13 times where an investor might have a faced a loss in excess of 25%. . If you are a long term investors (10-15 years) then nothing can stop you, you can continue

to invest in small cap. However if you are an individual investing in small cap

just because you friend advised or a random YouTube channel recommended you to

invest in small cap, then it’s time to be cautious and stay away, because the

end would be worse than you can ever imagine.

One Final Data –

Above table shows the returns profile if you stay invested for 7 years since 2010 and you can see that there are ZERO % chances that you will make more than 20% returns, leave alone a 34% return!

Our final thought – Do not invest in equity mutual fund if

your time horizon is less than 8 years. Do not invest in small caps when it’s

the flavor of the season and money is thrown as is there is no tomorrow. Be

sensible and take right advice from right people. Stay away from Zombies you will give you a bite and make you one!

For any financial Planning queries, Please contact Droplet Wealth @ 95513 73455/ 99623 99924 or email us at Invest@dropletwealth.com